The Definitive Guide for Arc Insurance Car Insurance

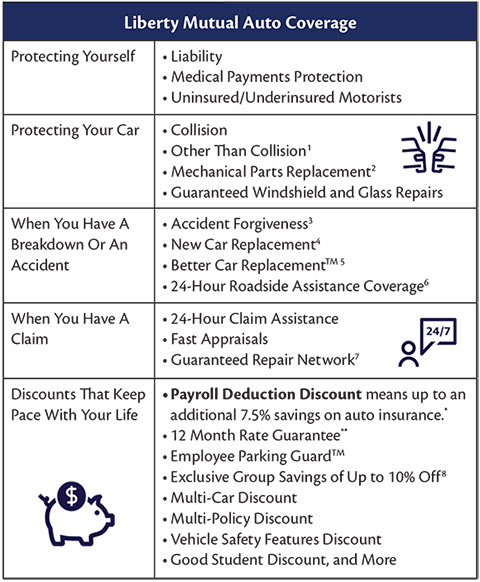

Yes, automobile insurance policy is needed for chauffeurs in nearly every state. It is not a demand in New Hampshire for motorists to get automobile insurance coverage, however drivers there do need to show proof that they can manage to pay the cost of a crash if it's their fault. Most vehicle drivers have car insurance policy since it is the law, yet that does not suggest you should only get the minimum needed protection.

If a mishap occurs, you want to know you have the appropriate protection to take care of any home or physical injury prices that might occur. The fallout from a cars and truck accident can be unbelievably lengthy and tiresome.

If your automobile is older and its market value is low, it may not deserve it to acquire these insurance coverages. Figure out just how much you can pay for to invest out-of-pocket if your vehicle is harmed as well as what coverage will cost before choosing whether it is worth purchasing to protect your automobile. Motorcycle Insurance Cincinnati, OH.

The Best Guide To Boat Insurance Cincinnati, Oh

This physical damage coverage uses no matter of that is at fault in the crash. Your auto obtains rear-ended while you are driving in quit and also go traffic. Collision Insurance coverage can aid cover the prices to repair your damaged back bumper. Allow's state the situation is turned around and you are the one that strikes somebody from behind.

Comprehensive Protection assists pay for damages done to your car in non-collision crashes. These can include damage due to all-natural disasters, criminal damage and also theft. (Yes, auto insurance coverage covers theft). For instance, hefty winds take down some tree branches in your yard. One of the tree branches drops on your car as well as dents the roofing system.

Normally, the cars and truck insurance plan follows the cars and truck that it is covering. If you provide your vehicle to a pal, typically, your vehicle insurance would certainly cover many of the insurance claims that could happen while your buddy is driving your automobile.

The smart Trick of Arc Insurance Car Insurance That Nobody is Talking About

You provide your auto to a buddy that needs to run an errand. While running the duty he inadvertently hits an additional car. Your crash insurance policy can aid cover the costs of the damages to your cars and truck (Insurance Agent Cincinnati). You'll require to submit the crash insurance claim with your insurance provider and pay the deductible.

You may likewise be held responsible for residential property damage as well as physical injury done to the other vehicle driver. In many cases, your close friend's insurance policy may enter play to aid cover excess damages that your policy can not cover. If your buddy does not have auto insurance policy, then you will certainly more than likely be fully in charge of all harms carried out in this at-fault accident.

It's additionally essential to point out that you can exclude people from your auto insurance plan - Motorcycle Insurance Cincinnati, OH. This suggests that certain individuals will not be covered by your vehicle insurance if they drive your cars and truck. If someone aside from you will drive your vehicle on a regular basis, check into whether you have the appropriate coverage.

Our Arc Insurance Cincinnati Oh Diaries

Yes, vehicle insurance is essential for drivers that get back for the holidays and will be driving. You need to maintain your youngsters on your insurance plan when they go away to university, even if they won't have a cars and truck with them. They will read this post here probably intend to utilize your cars and truck when they get back for vacations as well as vacations and also you'll intend to make sure that they have the appropriate degree of insurance coverage when driving your or any other automobile.

A slightly older car can often cost much less to guarantee than a brand-new one. This is since new vehicles have a higher market value and also will usually set you back even more to fix or replace. Automobiles that have gotten on the road for numerous years might be a lot more cost effective to repair than new cars since there can be an excess of parts for vehicles that are a couple of years old.

Facts About Arc Insurance Auto Insurance Revealed

Vehicles that are greater than a couple of years of ages, however, may set you back more to insure. This can be due to the fact that their parts are extra tough to find and repair services are a lot more pricey. They might also have actually dated security features, which can raise prices. Particular automobile makes and also designs cost more to guarantee than others.

This is because the cars and trucks' market price are greater as well as as a result cost more to replace or fix. Repairing a damage on a $15,000 car may be a routine work that numerous auto body stores can handle. Dealing with a damage on a $90,000 automobile might require a much more costly specialty automobile body store and cause greater fixing costs.

Generally, SUVs as well as minivans are several of the least expensive cars to insure. Thieves find some makes as well as models preferred than others. If you have a vehicle that routinely makes the checklist of regularly swiped vehicles, you may have to pay a higher costs to guarantee it. There are various other aspects that have a result on your auto insurance premiums.

The Only Guide for Car Insurance Cincinnati

This is particularly vital in the case of big liability insurance claims that, without obligation as well as space insurance coverage, can be financially ravaging. For a tiny cost, you can enhance the limitations of your responsibility protection considerably with umbrella protection.

Contrast Quotes From Top Firms find out here now and also Save Guaranteed with SHA-256 File Encryption